Dublin, June 07, 2023 (GLOBE NEWSWIRE) -- The "Global Pad-Mounted Switchgear Market Size, Share & Industry Trends Analysis Report By Type (Gas-insulated, Air-insulated, Solid-Dielectric and Others), By Voltage, By Application (Industrial, Commercial), By Regional Outlook and Forecast, 2023-2029" report has been added to ResearchAndMarkets.com's offering. The Global Pad-Mounted Switchgear Market size is expected to reach $7.3 billion by 2029, rising at a market growth of 5.3% CAGR during the forecast period.

S&C Electric Company Dc Combiner Box

Electro-Mechanical, LLC (Graycliff Partners LP)

ENTEC Electric & Electronic Co. Ltd

NOJA Power Switchgear Pty. Ltd.

The International Electrical Products company (Al Tuwairqi Holding Co. ltd)

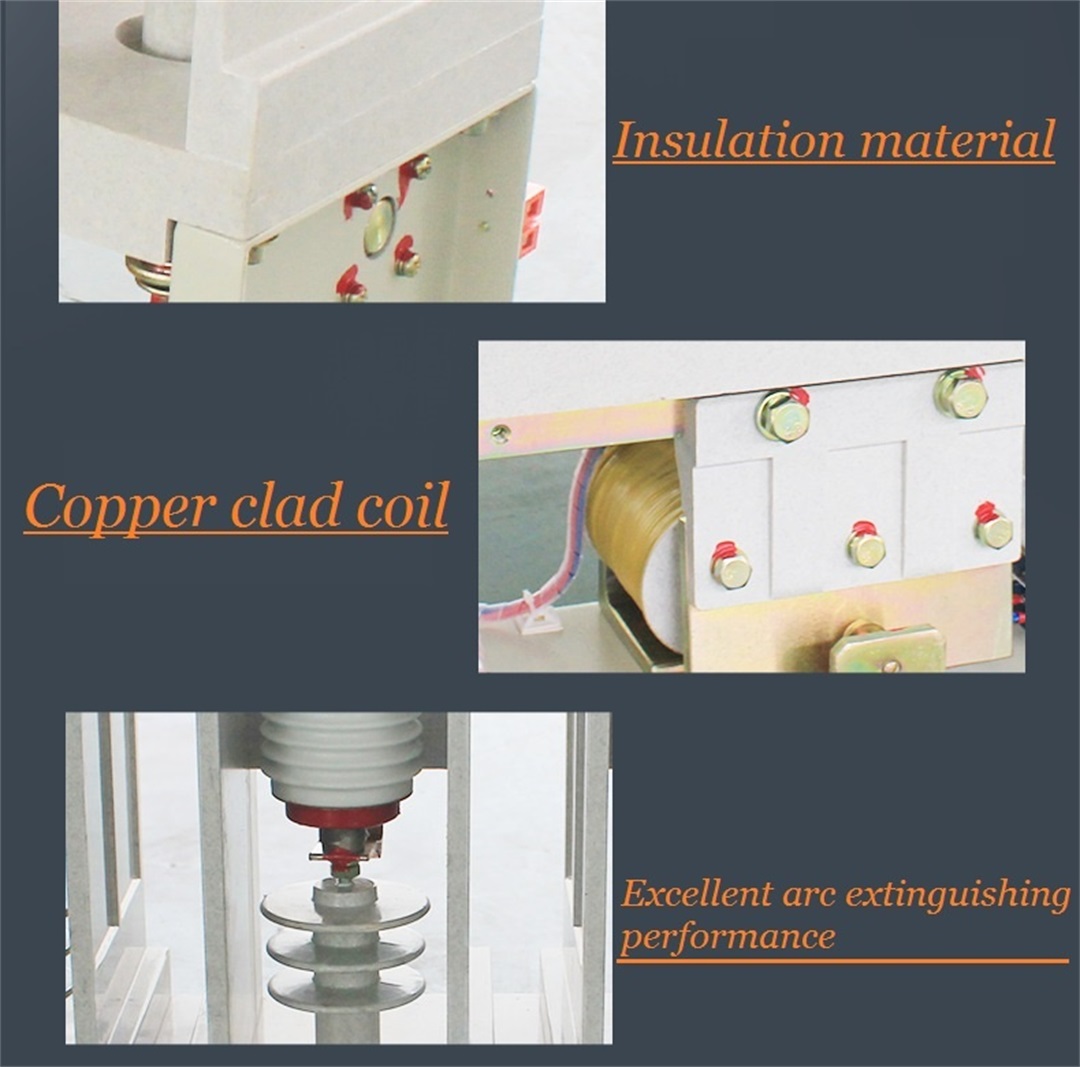

Electric power is transferred and distributed via a particular kind of electrical equipment called pad-mounted switchgear. It can be divided into various categories, such as gas-insulated pad-mounted switchgear, air-insulated pad-mounted switchgear, and others (e.g., vacuum). Circuit breakers are used in pad-mounted switchgear to prevent overloads and short circuits in the power supply. Typically, commercial, industrial, and residential applications use pad-mounted switchgear. Most pad-mounted switchgear is air-insulated, which contains circuit breakers to guard against short circuits or overloads in the power supply. Since many people and governments regard gas as a cleaner fuel than coal, the share of gas-insulated pad-mounted switchgear has been rising. The IEEE C37.74 standard specifies pad-mounted switchgear. Pad-mounted switchgear is used for subsurface distribution networks rated from 5 - 38 kV that must be functional above grade. The best alternative for feeder sectionalizing, circuit protection, and utility distribution applications is pad-mounted switchgear because of its outdoor-rated, low-profile, and tamper-resistant construction. To safeguard loads, isolate faults, and reduce outages, devices such as switches, fuses, as well as vacuum interrupters are employed. Up to six ways of pad-mounted switchgear are available in a typical insulated sealed tank. Air, SF6 gas, liquid, solid-dielectric-in-air technology, and solid materials are all examples of insulation methods. Circuit protection devices such as circuit breakers, fuses, and switches are called electrical switchgear and are used to isolate, protect, and control electrical equipment. A switchgear assembly or line-up groups one or more of these buildings. Switchgear is frequently found in medium- to large-sized commercial or industrial facilities, as well as across electric utility transmission & distribution (T&D) systems. In North America, IEEE and IEC determine the standards for electrical switchgear, while other regions of the world use IEC standards. Market Growth Factors

Rising demand for electricity worldwide Increased electricity demand and grid construction are driving market expansion. Using energy resources effectively is crucial, especially because of rising industrialization and electrical consumption. Emission-free energy sources, such as electricity transmission utilizing HVDC systems, have become more popular.

As a result, power consumption in the industrial, domestic, and commercial sectors has increased. Pad-mounted switchgear technologies have gained acceptance due to their usage in underground long-distance transmission and reduced energy prices. Due to increased energy consumption and the development of underground energy transmission, the market is expected to rise significantly over the next several years. Upgrades and expansions to the infrastructure supporting power distribution Transmission and distribution (T&D) networks must be dependable and stable due to the rising demand for energy. Only a system with abrupt power shorts and drops can provide uninterrupted electricity. In developed countries, substations are updated to guarantee a constant power supply with minimal losses.

This is accomplished by swapping outdated components for more contemporary, effective ones. These improvements are smart and much more resistant to overcurrent circumstances. Investments in distribution systems help the distribution system handle long-distance power flow and reduce energy losses brought on by strong currents. Hence, the market will grow in the upcoming years due to the rising investments in infrastructure improvements. The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations. Market Restraining Factors

High costs associated with the installation and maintenance of switchgear systems The local companies sell goods made in-house under their local brand. In regard to price competitiveness as well as the local supply system they maintain, which is challenging for international firms to do, these market participants from the unorganized sector outperform major players. If low-quality products are marketed as the industry leaders' products, the surge in switchgear sales from the gray market damages their reputation. The possibility for leading companies to raise their revenue is diminished by the rising sales from both the gray market and local players. All these factors hamper the growth of the market. Scope of the Study

For more information about this report visit https://www.researchandmarkets.com/r/3z6ro6

Power Distribution Box About ResearchAndMarkets.com ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.