The electric-vehicle (EV) market is estimated to grow at a 20 percent CAGR through 2030, when sales of xEVs are estimated to reach 64 million—four times the estimated EV sales volume in 2022.1 Based on data from the McKinsey Center for Future Mobility. Ensuring the EV component supply is sufficient to meet this rapid rise in estimated demand is critical, and the supply of silicon carbide (SiC) merits special consideration. Our analysis shows that compared to their silicon-based counterparts,2 That is, silicon insulated-gate bipolar transistors (IGBTs). SiC metal-oxide-semiconductor field-effect-transistors (MOSFETs)3 A MOSFET is an electronically controlled switch. used in EV powertrains (primarily inverters, but also DC-DC converters and onboard chargers)4 An inverter is a device that converts DC power from the EV battery to AC supply for the EV motor. provide higher switching frequency, thermal resistance, and breakdown voltage. These differences contribute to higher efficiency (extended vehicle range) and lower total system cost (reduced battery capacity and thermal management requirements) for the powertrain. These benefits are amplified at the higher voltages needed for battery electric vehicles (BEVs), which are expected to account for most EVs produced by 2030.

In this article, we will examine how SiC manufacturers, automotive OEMs, and others can seize the opportunities inherent in the projected EV market growth surge to create value and gain competitive advantages. Blue Sapphire Material

Between 2018 and 2022, projections for EVs’ share of the global light-vehicle market in 2030 increased 3.8 times, from around 17 million to 64 million units (Exhibit 1). This growth has been fueled by the expectation that EVs will reach total cost of ownership (TCO) parity with internal-combustion vehicles (ICEs) in many countries by 2024 or 2025,5 Excluding subsidies. With subsidies, TCO is already at parity between EVs and ICE vehicles. as well as by the regulatory actions taken and investments made in EVs and charging infrastructure as part of the push to meet net-zero targets.

The SiC device market, valued at around $2 billion today, is projected to reach $11 billion to $14 billion in 2030, growing at an estimated 26 percent CAGR (Exhibit 2). Given the spike in EV sales and SiC’s compelling suitability for inverters, 70 percent of SiC demand is expected to come from EVs. China, where anticipated EV demand is highest, is projected to drive around 40 percent of the overall demand for SiC in EV production.

Across EVs, the type of powertrain—BEV, hybrid electric vehicle (HEV), plug-in hybrid electric vehicle (PHEV), 400-volt, or 800-volt—determines the benefits and relative uptake of SiC. Because of their greater efficiency needs, 800-volt BEV powertrains are most likely to use SiC-based inverters.6 Based on data from the McKinsey Center for Future Mobility. According to our analysis, by 2030, BEVs are expected to account for 75 percent of EV production (up from 50 percent in 2022), while HEVs and PHEVs will make up the other 25 percent. Furthermore, we anticipate more than 50 percent market penetration for 800-volt powertrains by 2030 (up from less than 5 percent in 2022). Accordingly, we anticipate a significant tailwind for SiC devices in the coming decade.

The current SiC market is highly concentrated, with only a few end-to-end leaders. Indeed, the top two companies in the SiC wafer and device markets control around 60 to 65 percent of SiC market share (Exhibit 3).

The market rewards vertical integration, as evidenced by the dominance of the mostly integrated leading players. According to our analysis, vertical integration in SiC wafer and device manufacturing can improve yield by five to ten percentage points and margins by ten to 15 percentage points,7 Compared to a combination of pure-play providers across these segments of the value chain. partly from lower yield loss and partly from eliminating margin stacking at each step in the process (Exhibit 4). Higher yields are achieved from better control over design and faster yield ramps with closed-loop feedback between wafer and device manufacture.

Strategically, vertically integrated manufacturers can also offer a stronger value proposition to automotive OEMs because of higher supply assurance, which is noteworthy in light of recent supply chain challenges. Similarly, vertical integration also offers wafer players a hedge against commoditization, such as has occurred in the silicon market.

Not surprisingly, several leading manufacturers have already evolved toward vertical integration through M&A and partnerships. In particular, semiconductor device manufacturers have added upstream capacity in wafer materials manufacturing. This includes the STMicroelectronics’ acquisition of Norstel, Onsemi’s acquisition of GT Advanced Technologies (GTAT), and the Rohm Semiconductor acquisition of SiCrystal.8 For more on the STMicroelectronics–Norstel acquisition, see “STMicroelectronics closes acquisition of silicon carbide wafer specialist Norstel AB,” STMicroelectronics, December 2, 2019; for more on the Onsemi–GTAT acquisition, see “Onsemi completes acquisition of GT Advanced Technologies,” Onsemi, November 1, 2021; for more on the Rohm Semiconductor–SiCrystal acquisition, see “History of SiCrystal,” SiCrystal, accessed September 5, 2023. These and other acquisitions demonstrate confidence in the operational, financial, and strategic benefits of vertical integration.

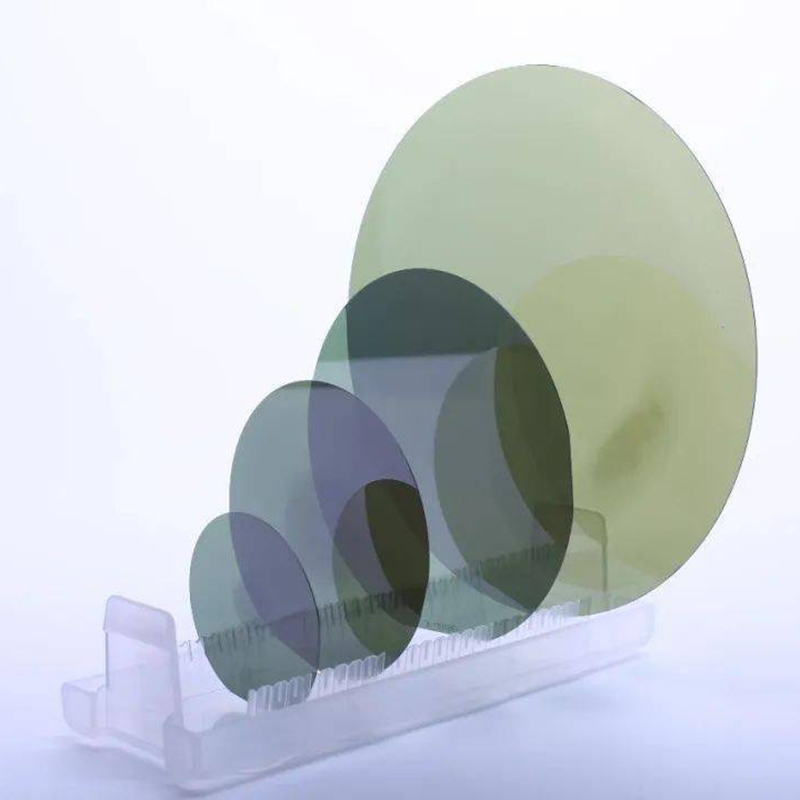

According to our analysis, a transition from the production and use of six-inch wafers to eight-inch wafers is anticipated, with material uptake beginning around 2024 or 2025 and 50 percent market penetration reached by 2030. Once technological challenges are overcome, eight-inch wafers offer manufacturers gross margin benefits from reduced edge losses, a higher level of automation, and the ability to leverage depreciated assets from silicon manufacturing. Our analysis projects the gross margin benefit of this transition to be about five to ten percentage points, depending on the level of vertical integration.

Volume production of eight-inch wafers in the United States is projected to begin in 2024 and 2025, when industry-leading manufacturers are slated to bring capacity online.9 McKinsey analysis based on announcements from SiC wafer and device manufacturers. Production of eight-inch wafers is expected to ramp rapidly thereafter, chiefly in response to demand and price pressures (especially from midtier-volume EV OEMs), as well as to cost savings realized by conversion to eight-inch SiC wafer fabrication.

Our analysis shows that eight-inch wafer substrates are still relatively more expensive per square inch compared to six-inch wafers, due to lower yields. However, the gap is expected to close for leading manufacturers in the coming decade because of process yield improvement and novel wafering technologies. For instance, we find that, compared to the conventional wafering technique with multiwire saws, laser-cutting techniques have the potential to more than double the number of wafers produced from one monocrystalline boule. And advanced wafering techniques such as hydrogen splitting could further increase the output.

Acute supply chain challenges, geopolitical considerations, the transition to 800-volt vehicles, and the resulting increase in demand for SiC MOSFETs have all prompted recent expansions of OEM involvement in semiconductor and SiC sourcing. Given recent supply chain disruptions and the developing SiC landscape, with anticipated major technological innovations, automotive OEMs engage in multiple sourcing models for both SiC-based EV inverters and the underlying SiC chips (Exhibit 5). Our analysis shows that, as the industry matures, preferences are likely to shift toward greater OEM involvement in sourcing SiC as well as designing inverters. This shift also manifests itself in a growing number of partnerships between SiC manufacturers and automotive OEMs.

Partnerships between SiC manufacturers and OEMs range from long-term supply agreements to strategic and development partnerships—and even to co-investments and joint venture agreements in manufacturing facilities. Our analysis of public announcements10 As of April 19, 2023. from 18 automotive OEMs representing more than 75 percent of 2030 BEV volume found that 12 OEMs (representing more than 60 percent of 2030 BEV volume) have already announced two or more partnerships with SiC manufacturers. Five OEMs (representing around 15 percent of BEV volume) have announced one partnership, while only one OEM (representing around 2 percent of BEV volume) has not announced a partnership with a SiC manufacturer. While this analysis is limited to announced partnerships, there is a clear trend toward automotive OEMs diversifying and securing their supply chain with nonexclusive partnerships (Exhibit 6).

This high level of OEM involvement indicates that incumbent and prospective SiC manufacturers that develop deep relationships with OEMs and have automotive-specific device capabilities will be best positioned to participate in the growth of this sector. SiC manufacturers seeking to ensure share of wallet may wish to secure partnerships early, given barriers to demonstrating technical proficiency and assuring access to supply. This is particularly pertinent in light of the long-term nature of many supplier–OEM relationships. Furthermore, less-established SiC manufacturers may need to build early partnerships with OEMs to achieve a proof of concept and demonstrate assurance of supply to be designed into automotive platforms. Our analysis shows that OEMs are likely to be open to multiple partnerships with less-established manufacturers to create new avenues of assured supply.

China is expected to remain the largest SiC market through 2030 (Exhibit 7), with growth driven by consumer demand and supported by popular incentives, such as EVs’ exemption from license plate quotas. According to McKinsey research and analysis, this market is approximately one-third Chinese OEMs and two-thirds foreign OEMs in China, a mix that is expected to shift toward Chinese OEMs and approach a more even split by 2030.

Currently, non-Chinese SiC manufacturers supply 80 percent of the wafer market in China and more than 95 percent of the device market. However, our analysis shows that Chinese OEMs are increasingly seeking local supply sources due to geopolitical and supply assurance considerations. Given sufficient capacity and technological performance, Chinese OEMs are expected to broadly shift procurement to local suppliers, from what is currently approximately 15 percent to around 60 percent by 2030 (Exhibit 8).

This shift to local procurement in China is expected to be enabled by a rise in Chinese players across the whole SiC value chain—from equipment supply, to wafer and device manufacture, to system integration. Chinese equipment suppliers already cover all major SiC fabrication steps and have announced investments to ramp up capacity through 2027. However, clear supply leaders have yet to emerge in the Chinese ecosystem.

The accelerating adoption of EVs and the increasingly vital role of SiC in the growing EV market denotes fundamental implications for players across the SiC value chain. While there is no paramount strategy to lead with increased market share or value creation, some considerations are imperative for players to position themselves for primacy in the shifting SiC market.

Well-positioned automotive OEMs and tier-one suppliers will have EV and SiC adoption and timing plans that are aligned with the market and their peers. As OEM and tier-one partnerships are formed early in the development process, SiC inverter and semiconductor supply chain strategies tailored to internal capabilities and growth strategy—for example, co-development partnerships with SiC device manufacturers versus more straightforward supply agreements—are highly advantageous in securing and maintaining partnerships. With advancements in technology such as trench topologies for transistors and hybrid Si-SiC inverter designs and continued shifts in the value chain, designing a holistic sourcing strategy that takes uncertainty into account will similarly serve OEMs and tier-one suppliers well.

Defining a SiC growth and investment strategy that keeps pace with the growing opportunity for SiC across the EV and other markets is central to any well-situated semiconductor component manufacturer’s outlook. Access to the market with appropriately defined partnerships with automotive OEMs and tier-one suppliers is likewise vital, as is continued investment in technology development, capacity ramp-up execution, and cost degression—particularly in light of a transition to eight-inch wafers. Players will continue to shape and be shaped by build-buy-partner decisions across the manufacturing value chain, including those related to substrate, epitaxy, and devices.

Ideally, a SiC investment thesis incorporates an assessment of reinvestments and time to maturity that is aligned with the market, value chain, and technology dynamics. It is important for investors to consider which players are likely to emerge as leaders as the market matures, whether announced capacities are likely to come online as scheduled, and whether there are opportunities to disrupt and create substantial value with strategically chosen investments.

Incentives or ecosystem enablers can help governments support local demand for SiC for use in EVs and other applications. International frameworks that support the value chain and safeguard national interests could help support a global supply chain while fulfilling demands for localization and supply resiliency.

The adoption of EVs represents a significant opportunity for players in the silicon carbide value chain. Competitive gains will likely be realized by those companies that attend to trends and opportunities in the SiC ecosystem and quickly build key capabilities and partnerships to support their growth ambitions. The SiC value chain is dynamic and has a high degree of uncertainty. There have been significant shifts in the demand environment: changes in inverter design and the MOSFET need per inverter; the continued acceleration of EV demand; the value chain, including emerging players in China and investments in the SiC value chain by nontraditional players such as automotive OEMs; regulatory postures; and technology, including the rise of new wafering techniques improving yield. In this environment, all market participants gain strategic advantages from monitoring developments on an ongoing basis and building flexibility into their plans.

Albert Brothers is a consultant in McKinsey’s New York office; Ondrej Burkacky is a senior partner in the Munich office; Julia Dragon is an associate partner in the Frankfurt office; Jo Kakarwada is a consultant in the Carolinas office; Abhijit Mahindroo is a senior partner in the Southern California office; Jwalit Patel is an associate partner in the Dallas office; and Anupama Suryanarayanan is an associate partner in the Silicon Valley office.

Silicon On Sapphire Wafers The authors wish to thank Michael Guggenheimer, Zachary Salyer, Dennis Schwedhelm, Brandon Strecker, Andreas Tschiesner, and members of the McKinsey Center for Future Mobility team for their contributions to this article.